|

|

|

|

|---|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

|

|

home loans edwardsville il: smart options for buyers and refinancersWhat to expect in the Edwardsville marketEdwardsville blends university energy with established neighborhoods, so home financing needs vary. Local credit unions and regional banks often pair community insight with competitive rates, while national lenders bring broad programs. Expect attention to taxes, insurance, and appraisal nuances across Madison County, plus timing considerations around campus moves. Pros and cons of local home financingShopping locally can feel personal, but it still pays to compare. Consider these trade-offs before locking a rate.

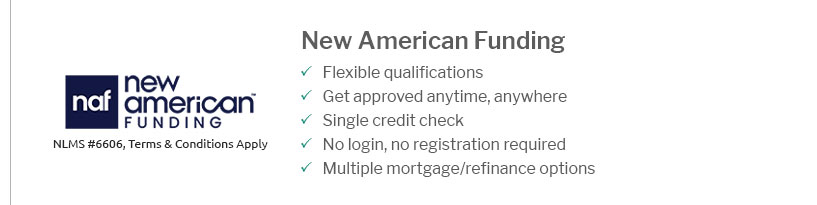

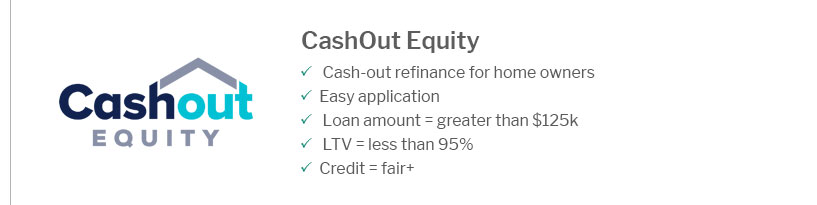

How to compare lenders and loan typesWeigh conventional, FHA, VA, or USDA options against credit score, down payment, and mortgage insurance. Look beyond APR to fees, rate-lock length, and discount points; a slightly higher rate with lower costs can win for short stays.

A clear plan helps you bid confidently and refinance prudently if rates shift.

|

|---|